Why your favourite chocolate bars are shrinking

Last July, I received a message from one of my favourite bakeries: “I’m excited to share Golden Chantilly’s new menu with you. Why the change? Recently, the cocoa industry has faced unprecedented challenges, with soaring prices and severe shortages of cacao beans due to pod disease and fluctuating weather patterns. In response, Golden Chantilly didn’t give up. Instead, we spent the last three months crafting new recipes and products.”

Ericka Fernandes, owner of Golden Chantilly and specialist in French desserts, has always been particular about her ingredients. Before the global price hike, she exclusively used Callebaut chocolate – white, milk, dark, and gold. “Callebaut cocoa powder now costs Rs 9,000 per 5 kg pack. I’ve had no choice but to shift to Callebaut’s Van Houten, which is slightly cheaper.”

Bakers and confectioners worldwide have been grappling with cocoa price surges over the last seven to eight months.

Global impact

Around 80% of the world’s cocoa comes from West African countries like Ghana, Ivory Coast, Nigeria, and Cameroon. When crop failures hit West Africa, it sent global cocoa prices skyrocketing. This increase rippled across the world, including India, where dry cocoa bean prices jumped from Rs 180 per kg to Rs 360, eventually reaching Rs 1,000 per kg by May this year.

A report on Indian chocolate industry trends pegs the current industry size at USD 2.31 billion, with an annual growth forecast of around 7%. The key players include Mondelez India (formerly Cadbury India), Nestle India, Ferrero India, Mars International India, and Hershey India. The country also has a rising artisanal chocolate scene. In the past decade, the premium chocolate market has grown significantly, with dark chocolate gaining popularity. In fact, reports suggest dark chocolate sales are growing faster than milk chocolate.

Bean-to-bar

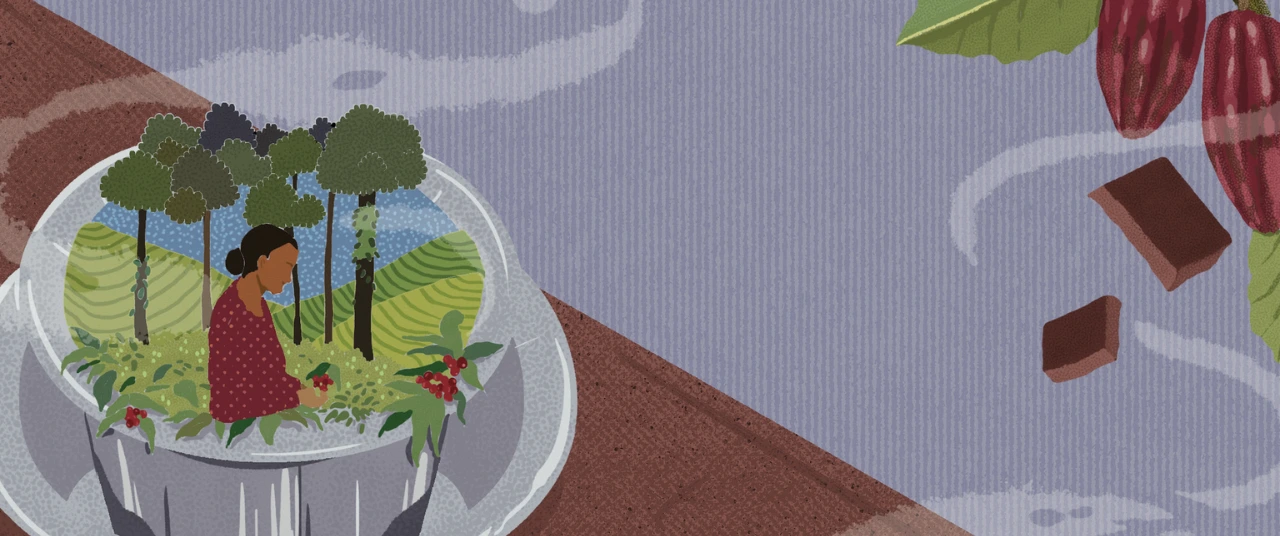

Bean-to-bar chocolate brands are popping up across India, and while they do make milk chocolate, their main focus is on dark chocolate. The term "bean to bar" emerged in the early 2000s and means the chocolate maker handles every step, from processing raw cacao beans to packaging the final bar. Farmers in South India's cacao-growing states like Kerala, Karnataka, Andhra Pradesh, and Tamil Nadu have benefited from these brands purchasing their cacao. The global cocoa shortage presents a big opportunity for Indian farmers.

Cacoa can grow as a multilayer crop, allowing farmers to supplement their income with minimal extra effort. Additionally, artisanal chocolate brands have long been committed to paying farmers fairly, often offering much higher prices than the bigger companies.

Prajnay Garg of Darkins Chocolates aims to bring out the best in Indian chocolate, from its flavours to its origins. “Five years ago, I was keen to invest into craft beer, but my partner, Richa, convinced me to look into chocolate. We travelled around many farms and then picked a couple of farms that we source from. We also source our material from a few small aggregators,” he said.

Brands like Paul and Mike and Manam Chocolates work closely with farmers, providing them with fair income and even educating them on fermentation processes. These companies treat farmers as partners, not just suppliers.

“We’ve been supporting farmers for ten years. While we don’t have the buying power of the larger companies, we ensure better quality lives for the farmers through our efforts.” said Fabien Bontems, co-founder of Mason and Co Chocolates in Puducherry.

Local consumption

A study by the International Cocoa Organisation shows that India’s chocolate consumption is just 100 to 200 grams per person each year, far below the 5 to 10 kilograms seen in Europe. India’s chocolate market has long been controlled by major brands, but things are shifting. Big companies like Nestle, Mondelez, and Hershey’s are protected by long-term pricing agreements, while smaller brands are more at risk. To cope, the industry is raising prices, launching new products with less chocolate, and making chocolate bars smaller.

In India, big brands like Parle and Amul have announced a 10-15% price increase. The Whole Truth, a confectionery brand, has stopped selling their milk chocolates and raised the price of their dark chocolates. Paul and Mike are also planning to hike prices soon. Many smaller brands have been forced to raise their prices by 5% to 25%. Darkins chocolates have increased their prices by 25% across all products.

“We’re now selling a bar for Rs 395/- that’s an 18% increase from the previous prices. We’ve tried to absorb a huge amount of the increase in cost of ingredients to us so it’s natural that we are facing some challenges,” said Bontems.

Mona, a baker and chef who owns Mona’s Coffee Shop in Goa, has also had to raise her prices after delaying it for over a year. “I haven’t had a single customer quibble about the increase in prices,”she said.

Changing consumers

“When people crave chocolate, they want chocolate, no matter what the price is,” said Judy Da Costa, a chocolatier and bakery supplier. Most businesses in the chocolate industry have found their customers to be accommodative of price increases.

Judy, who regularly supplies chocolate to hotels, restaurants, and bakeries, noticed that after prices peaked in April, sales didn’t drop significantly since it was already the off-season. Consumer preferences have changed over time and will likely keep evolving. “Our customer base is very conscious and aware. They have a high amount of trust in us. So none of them minded when our prices increased. For newer customers who prefer sweeter chocolates, the milk chocolate has emerged as a preferred option.”

Despite having loyal and understanding customers, many in the industry know that price fluctuations aren’t over yet. When asked about the future, Bontems is less optimistic, saying, “I don’t think global warming is improving.” As global food security is under threat, it’s up to consumers to make informed choices and support food producers however possible.

Explore other topics

References

1. J.P. Morgan. Cocoa prices. https://www.jpmorgan.com/insights/global-research/commodities/cocoa-prices

2. Statista. (2023). Cocoa bean production worldwide by region. https://www.statista.com/statistics/263855/cocoa-bean-production-worldwide-by-region/

3. The New Indian Express. (2024, May 6). Cocoa price crosses Rs 1k mark in Kerala; farmers wait and watch. https://www.newindianexpress.com/states/kerala/2024/May/06/cocoa-price-crosses-rs-1k-mark-in-kerala-farmers-wait-watch

4. Mordor Intelligence. (2023). India chocolate market. https://www.mordorintelligence.com/industry-reports/india-chocolate-market

5. Food and Beverage News. (2023). The sweetening chocolate market in India. https://www.fnbnews.com/Top-News/the-sweetening-chocolate-market-in-india-77738

6. VitnRich. (2023). The market of dark chocolate in India. https://vitnrich.com/blogs/news/the-market-of-dark-chocolate-in-india?srsltid=AfmBOoqkiLiV6wY9S1pBsePCPuDr6yqhPEKcOyWeKhMcdAXdRn0ttJEK

7. Tamil Nadu Agricultural University. from https://agritech.tnau.ac.in/horticulture/horti_plantation%20crops_cocoa.html

8. WARC. (2023). The changing market for chocolates in India. https://www.warc.com/content/feed/the-changing-market-for-chocolates-in-india/en-GB/8893

9. News18. (2023). Amul chocolates brace for price hike amid surging cocoa costs: Report. https://www.news18.com/business/amul-chocolates-brace-for-price-hike-amid-surging-cocoa-costs-report-8843715.html

.png)